e-Transfers: Instantaneous and No Cost to the Church

If you’ve ever had to email money from your bank account to someone, you know how fast Interac e-Transfers work. Originally intended for individual to individual transfers, many community associations, organizations, charities and congregations are using this giving method, with appropriate processes in place to protect both the donor and the recipient. Fees range from free to $1.50 per transaction for the person sending the funds. To receive e-transfers, your church will need an email address that can be used to deposit the e-Transfers and an account at a financial institution that is part of the Interac Network.

In order to be allowed to accept e-Transfers, the church’s online banking set-up must allow online transactions. To do this, banks usually require the debit card(s) associated with your church’s bank account to be the kind that have a spending limit. This enables online banking transactions, and consequently allows e-Transfers. This can also present new security risks for the account, however it is important to remember that there is also an electronic trail for every transaction!

In order to be allowed to accept e-Transfers, the church’s online banking set-up must allow online transactions. To do this, banks usually require the debit card(s) associated with your church’s bank account to be the kind that have a spending limit. This enables online banking transactions, and consequently allows e-Transfers. This can also present new security risks for the account, however it is important to remember that there is also an electronic trail for every transaction!

Note: Because the fees are charged at source, the donor assumes the cost and the fee is not included in their donation receipt. (Unlike fees paid by the church for credit card/debit transactions, which is included in the tax credit receipt given to the donor.) Because the fees are so small, donors don’t usually mind absorbing them and many personal banking accounts now offer unlimited interact e-transfers.

Because this type of giving is new and because it can mean changing the banking set-up for the church, the Session should consider and approve it before e-Transfers are received. The process could be facilitated by appropriate people in the congregation who will work to protect both donors and the congregation. It is a good idea to talk with both your bank and your auditors as these processes are established.

Keep the following in mind as you set up your e-Transfer processes:

- Ensure there is an electronic trail of the transfer of funds and email records for both the donor and the congregation.

- Determine who is responsible for managing the e-Transfers. When the e- Transfer email is received, it can be forwarded to two people—perhaps the treasurer for deposit and the envelope steward to record the gift for receipt. Having two people involved helps safeguard the assets of the church and the reputation of those involved.

- Use an official church email address to receive the gift rather than a personal email address. You might want to use or create a specific email address for gifts so that only the people who are responsible for receiving the gifts have access to it. Keep copies of the emails informing of the transfer in your financial files with other donation records.

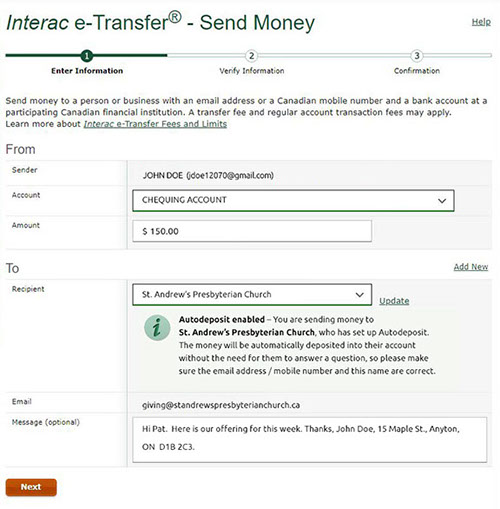

- Set up your account so that the e-Transfers are automatically deposited. This bypasses the Question & Answer password step (which can be insecure) and prevents someone from mistakenly depositing the funds into their personal bank account. When the donor is making the transfer, they will be informed that the e-Transfer money will be directly deposited.

- Be sure to get the full name and address of the donor so that you can issue the charitable tax receipt. Remember that receipts must go to the person who sent the funds—so donors must send the funds from their own bank account.