Winter 2019

2020 Member Contribution Rates and MQI

MQI: Every year the General Assembly approves a new Minimum Stipend and Allowance schedule, found in the Acts and Proceedings. This includes a new Maximum Qualifying Income (MQI), which is the maximum figure that can be used for pension and group insurance calculations. In 2020 the MQI will be $74,880 (2019 A&P, p. 229).

MQI is calculated for clergy as stipend + 60%. For non-clergy MQI is calculated as salary + Health and Dental premium, if applicable. The Health and Dental premium for 2020 is $4,502. If the calculated MQI equals more than the maximum set by the General Assembly, then the maximum is used to determine payroll deductions.

Member Pension Contributions: Members of the pension plan contribute based on a percentage of their MQI. In 2020 the member pension contribution rate will remain 9% of the member’s MQI.

Group Insurance Rate: In 2020 the group insurance rate will increase to 1.5%. The group insurance rate is based on plan member usage and the resulting costs. Increases in Long-term disability (LTD) claims and Life Insurance claims are factors that can drive the cost up and result in the need for a higher rate. For these benefits to remain tax free when claimed, the premium must be fully paid by the member.

The Board recognizes that this is a higher increase than members have experienced in the past, however it is required due to increased plan usage by members. While this does result in a higher premium, it also demonstrates that this plan is of vital importance to many of our colleagues and is a crucial benefit.

Member pension and group insurance contributions are made by payroll deductions by your treasurer or payroll administrator.

Meditation for Mental Health

Meditation has been practiced for thousands of years in cultures all around the world. The connection between mind and body has been well established by science, and in recent years, the medical community has been promoting meditation as a method of dealing with stress and improving overall mental health.

Meditation is a skill, and like any skill it requires practice. Often, those new to meditation don’t know how or where to start. The following tips and tricks can help get you started on your meditation practice.

Elements of meditation

Meditation is a personal practice, and one that will vary among different individuals. There are, however, some common elements that may be included in a meditation practice.

Focused attention. You can focus your attention on such things as a specific object, an image, a mantra, or even your breathing.

Relaxed breathing. This technique involves deep, even-paced breathing using the diaphragm muscle to expand your lungs. The purpose is to slow your breathing, take in more oxygen, and reduce the use of shoulder, neck and upper chest muscles while breathing so that you breathe more efficiently.

A quiet setting. Establishing a meditation practice will come more easily if you find a quiet place with few distractions.

A comfortable position. You can practice meditation whether you’re sitting, lying down, walking, or in other positions or activities. Just try to be comfortable so that you can get the most out of your meditation. Aim to keep good posture during meditation.

Open attitude. Let thoughts pass through your mind without judgment.

Everyday ways to practice meditation

Some beginners choose to attend special meditation centres or group classes led by trained instructors, but you can also practice meditation on your own. Some choose to start and end each day with an hour of meditation. Don’t let the thought of meditating the “right” way add to your stress. Here are some easy ways you can incorporate meditation into your daily routine.

Scan your body. Focus attention on different parts of your body. Become aware of your body’s various sensations, whether that’s pain, tension, warmth or relaxation. Take deep slow breaths and imagine you are breathing heat or relaxation into and out of different parts of your body.

Walk and meditate. Combining a walk with meditation is an efficient and healthy way to relax. When you use this method, slow down your walking pace so that you can focus on each movement of your legs or feet. Don’t focus on the destination.

Engage in prayer. Prayer is the best known and most widely practiced example of meditation. You can pray using your own words or read prayers written by others.

Interested in learning more about meditation? Try these resources!

EAP: ComPsych has resources online to help get you started with meditation and answer some common questions about what meditation is and what it can do. Check the Online Resource Centre

Apps: There are plenty of meditation apps that will guide you and your meditation practice as you build your skills. Some popular ones are Head Space, Calm, and The Mindfulness App

Retirement Planning through Life Stages

Retirement can feel like it is a lifetime away, especially if you are at the beginning of your career. But while your retirement date may be years away, planning for your retirement should start as early as possible. As you move through life, you will encounter different financial challenges with the changing demands on your income. Knowing how to plan for this major life goal at every life stage will set you up for success. We hope that the information below will get you started, no matter what life stage you find yourself in.

Early Career: The thrill of beginning a new job with regular income is more often than not tempered by a corresponding list of expenses such as rent, utilities, student loans, car payments, etc. It is a common mistake during this life stage to put off retirement savings for another time, when income is higher or expenses are lower. However this is the absolute best time to start saving, even a small amount, so that it can grow with interest over the coming decades. During this time, it would be wise to meet with an accredited financial planner to help establish a budget that includes retirement savings. While paying down debts is often a top priority during this time, maintaining even a small contribution to retirement savings is prudent.

Middle Career: This is an excellent time to revisit retirement strategies and meet with a professional to determine how your income can be used to its greatest potential. While this is often a time of big life changes and new financial constraints such as a home or car purchase, expanding a family, starting education savings and paying off any remaining student debt, it is also a time in your life when retirement savings are of vital importance. Many employers, including The Presbyterian Church in Canada, offer a pension plan to employees. This is a good time to familiarize yourself with the type of pension plan that is offered by your employer, what the benefits are and how it can fit into your overall retirement goals.

Late Career: Retirement is around the corner! Welcome to your maximum earning years. This is a time when your children have likely moved out of the house, your mortgage payments have an end in sight, and your most significant expenses are almost entirely paid off. As these expenses wrap up, it is wise to once again meet with your financial planner to determine how the newly freed up income should be redirected. This is a time to maximize your retirement savings wherever possible. A professional can help guide you to the best places to save and invest your extra income so that your retirement years can be thoroughly enjoyed.

Choosing a Financial Planner

In Canada, outside of Quebec, there is no protection of the terms “Financial Planner” or “Financial Advisor.” This means that anyone can claim those titles, regardless of the education, the institution they work for and the model of their business. It is important to diligently research any potential candidates for this important role in your life.

1. Check if a financial planner is registered; this will outline what training they have received and in what areas of your financial life they are qualified to offer guidance.

2. Check to see if there has been any disciplinary action or complaints filed against them.

3. Interview them. This step is critical, and it is important to remember that not all professionals in the role of financial planner are obligated to act in your best interest. Asking questions before hiring them can help you determine who will best help guide you to your financial goals. You should ask them:

a. About their training and experience

b. How long they/their firm has worked in the field

c. What products and services they offer

d. How they are paid (salary, commission or other fees)

e. References of current and past clients

More interview questions and other resources that will be helpful in the selection process can be found here: www.canada.ca/en/financial-consumer-agency/services/savings-investments/choose-financial-advisor.html

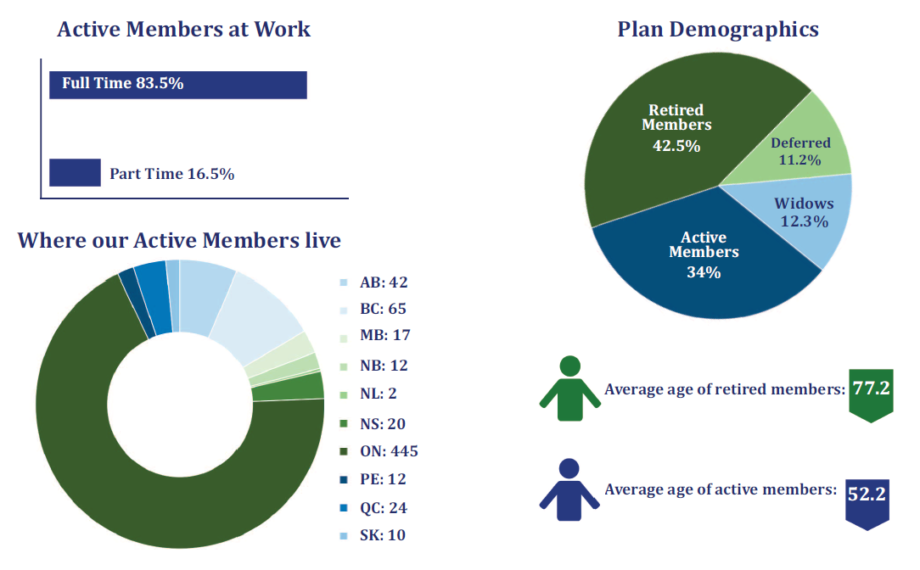

Fast Facts: Our Membership at a Glance

Online Learning with Your EAP – 2020 Webinars

After the Holidays: Managing That Debt

January 21, 2020 – 2:00 p.m. (Eastern)

Holiday shopping can sink even the best budget if one is not careful. And post-holiday credit card bills can cause high levels of stress. This workshop will help you figure out how to get out of debt quickly and cost-effectively and take steps to make sure you don’t end up in debt again next year.

Talking About the Tough Subjects With Your Parent or Older Loved One

March 24, 2020 – 2:00 p.m. (Eastern)

This course is designed to help adult children and their aging parents or loved ones deal with those sensitive topics that make conversations difficult. How do you talk with your parents about issues associated with aging such as money, moving, health, wills, driving and safety? The course will discuss approaches and strategies to effectively address these and other concerns that impact elderly adults.

Time Management Principles

April 21, 2020 – 2:00 p.m. (Eastern)

Work, family and personal life responsibilities can feel overwhelming, and it sometimes seems as if a 24-hour day simply isn’t long enough. By following the principles discussed in this workshop, you will learn strategies to feel more in control of your very busy life.

Kids and the Internet: Becoming a Cyber Savvy Parent

May 26, 2020 – 2:00 p.m. (Eastern)

Children are learning how to use computers at younger ages— many are more computer-savvy than their parents! This workshop will address the need for children to be familiar with computers in today’s society without letting the computer dominate their child’s time.

Member Survey

We always love to hear from you! What do you most want to see in these newsletters? Is there a question about your pension and benefits that you have been waiting to ask? Take our member survey at bit.ly/windowsurvey

About this newsletter

This newsletter provides summary information about the Presbyterian Church in Canada pension and benefits plans. It is not intended to be complete or comprehensive, or to provide legal or medical advice. If there are any discrepancies between this newsletter and the wording in the legal documents that govern the plans, the legal documents will apply in all cases. Our Pension Plan registration number is 0368902.