Page 10 - Presbyterian Connection, Spring 2020

P. 10

10

PRESBYTERIAN

SPRING 2020

presbyterian.ca

A Well-Balanced Legacy

By Maggie Leung and Jim MacDonald, Stewardship & Planned Giving

Your last will and testament is the fi- nal paragraph of the story of your life: a summary of the people and causes you cared about most. When creat- ing or updating your will, you may ask yourself, “Can I give a gift to the church and provide for loved ones?” The answer is a resounding “Yes!”

and by using the tax advantages of charitable gifts—it won’t cost your heirs as much as you think. Your es- tate can apply charitable tax credits in the year of your death (as well as one year prior and as many as five years after).

Let’s imagine a member of a medi- um-sized church in a small commu- nity somewhere in Ontario. We’ll call her Mrs. Smith.

Mrs. Smith has two heirs: an adult son and an adult daughter. Over a lifetime of mortgage payments, in- vestments and savings, Mrs. Smith and her late husband built up a port- folio of assets that she plans to leave to her beneficiaries. To demonstrate how the choices Mrs. Smith makes in her estate plan will affect her chil- dren’s inheritance, let’s explore three scenarios.

When you plan to give to the church in your will, the amount the church receives will usually far exceed the cost to your estate.

Connection

STEWARDSHIP

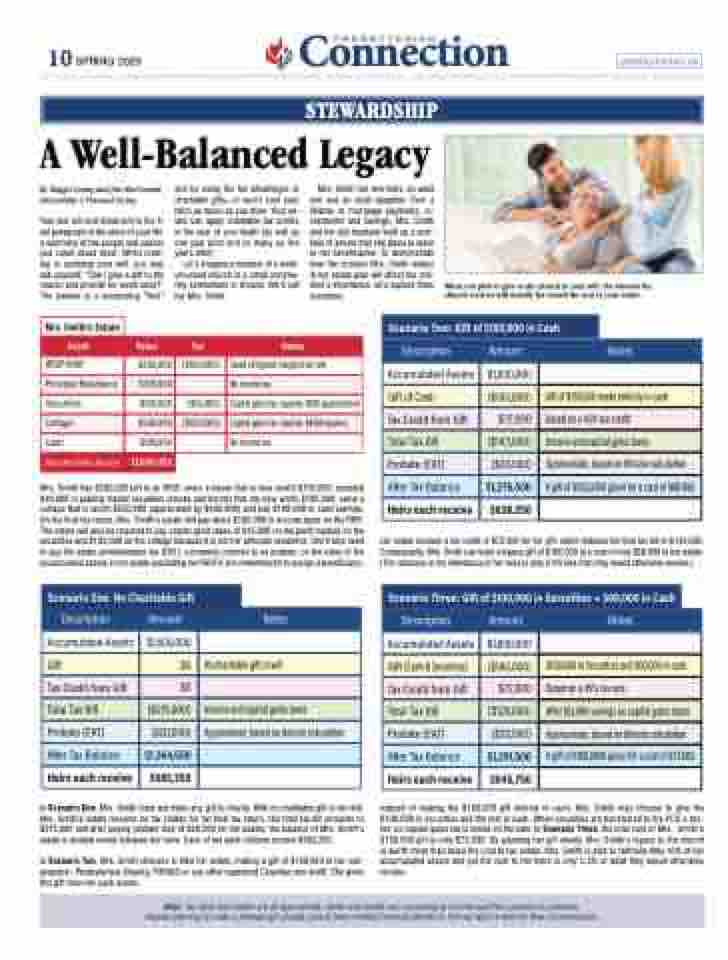

Mrs. Smith has $200,000 left in an RRIF; owns a house that is now worth $700,000; invested $40,000 in publicly traded securities (stocks and bonds) that are now worth $100,000; owns a cottage that is worth $500,000 (appreciated by $400,000) and has $100,000 in cash savings. On her final tax return, Mrs. Smith’s estate will pay about $100,000 in income taxes on the RRIF. The estate will also be required to pay capital gains taxes of $15,000 on the profit realized on the securities and $100,000 on the cottage because it is not her principle residence. She’ll also need to pay the estate administration tax (EAT), commonly referred to as probate, on the value of the accumulated assets in her estate (excluding her RRIF if she remembered to assign a beneficiary).

Her estate receives a tax credit of $72,000 for her gift, which reduces her final tax bill to $143,000. Consequently, Mrs. Smith can leave a legacy gift of $160,000 at a cost of only $88,000 to her estate. (The reduction in the inheritance of her heirs is only 6.4% less than they would otherwise receive.)

In Scenario One, Mrs. Smith does not make any gift to charity. With no charitable gift in her will, Mrs. Smith’s estate receives no tax credits for her final tax return. Her total tax bill amounts to $215,000 and after paying probate fees of $20,500 on her assets, the balance of Mrs. Smith’s estate is divided evenly between her heirs. Each of her adult children receive $682,250.

In Scenario Two, Mrs. Smith chooses to tithe her estate, making a gift of $160,000 to her con- gregation, Presbyterians Sharing, PWS&D or any other registered Canadian non-profit. She gives this gift from her cash assets.

Instead of making the $160,000 gift entirely in cash, Mrs. Smith may choose to give the $100,000 in securities and the rest in cash. When securities are transferred to the PCC’s bro- ker, no capital gains tax is levied on the sale. In Scenario Three, the total cost of Mrs. Smith’s $160,000 gift is only $73,000. By planning her gift wisely, Mrs. Smith’s legacy to the church is worth more than twice the cost to her estate. Mrs. Smith is able to faithfully tithe 10% of her accumulated assets and yet the cost to her heirs is only 5.3% of what they would otherwise receive.

Note: Tax rates and credits are all approximate. Rates and credits vary according to income and from province to province. Anyone planning to make a planned gift should consult their certified financial planner to find out what is best for their circumstances.